“Did you know even vampires enjoy our newsletter? It’s got great circulation.”

Our Autumn newsletter has been written in an undeniably volatile time in the energy industry, making it hard to know where to start. Saying that, the theme was clear from the start with the words of gothic writer Tim Burton: ‘for some of us, Halloween is everyday’ ringing true amidst a context of hair-raising wholesale price hikes and spine-tingling supplier exits.

UK energy crisis

SoLR

Industry reporting

Greenwashing

TPI regulation

Policy headlines

Double, double toil & trouble: summary of the UK energy crisis

The UK energy system has been a hot topic of the mainstream media this quarter, with supplier failures, market wide price hikes and media reports stoking concern around the security of supply. A ‘perfect storm’ of national and international market forces, which have been bearing down on the already tight profit margins of UK energy suppliers.

Wholesale gas prices

Wholesale gas prices have further fed an increase in wholesale power prices, with EU carbon market rules incentivising the switch from coal to gas fired power stations and the UK’s relative reliance on gas-fired generation stoking demand. This effect has only been magnified by lower than seasonally expected wind and solar output across the UK and Europe and a fire at a major French interconnector limiting the UK’s import option.

Regulatory challenges: default price cap

The pressures on UK suppliers, especially in the domestic market, have only been heightened by aspects of the existing regulatory framework. The default price cap, which applies a maximum unit rate and standing charge for domestic consumers on default (deemed/out of contract) or standard variable tariffs, is intended as a ‘backstop protection’ to domestic energy consumers who may not proactively engage in the market. Essentially the cap operates on the logic that such tariffs are the most expensive in the market, with customers able to secure a better deal through agreeing a contracted fixed price. However, this logic has been challenged by the market conditions of the past month, with some suppliers reportedly quoting fixed contract prices that would cost the average domestic consumer around £400 a year more than if they were on a default capped tariff.

This is not a tale of greedy suppliers but a demonstration of how the cap is unable to react to volatile market conditions in a timely manner, with it only being amended twice a year (April & October).

Regulatory challenges: FiT & RO scheme payments

As if this wasn’t enough to get the cauldron bubbling over, price pressures have come at a key time in the regulatory calendar, with large payments due from electricity suppliers under the existing Renewables Obligation and Feed in Tariff Schemes. With several suppliers exiting the market with outstanding sums payable under the respective schemes, market analysts have suggested mutualisation is inevitable. Those electricity suppliers who have paid their own initial obligation in full will have to wait until the passing of the late payment deadline on the 31st October before they have a final view of the remaining payments they will now be liable to cover in accordance with their market share.

Trick or treat? What is a Supplier of Last Resort (SoLR)?

In the unfortunate event that a supplier does cease trading, Ofgem will step in ensuring that consumers are somewhat protected, through the appointment of a Supplier of Last Resort (SoLR). This procedure, established in 2003, ensures that when a supplier failure occurs, its customers are readily transferred to a new energy supplier without interruption to their gas or electricity supply. For domestic consumers Ofgem further ensures that any account credit accumulated with the old supplier is protected and transferred over. Business energy however is not protected in the same way, meaning any credit balances will essentially be lost unless the business consumer is able to contact the relevant administrator, and even this promises no guaranteed success.

Ofgem takes responsibility for finding the customers of the closed company a new supplier. The standard practice is to place the accounts out to tender for new suppliers to bid over. This process, which usually lasts a few days, is designed to get customers the best deal, although in most cases a new supplier will place customers on a ‘deemed rate’ contract which, although usually expensive, does not carry a fixed duration, exit fee, or requirement for termination. Recent market challenges, including the current cap applied to such domestic default tariffs, have reportedly dissuaded many suppliers from bidding in the most recent round of SoLR tenders, with suggestions that Ofgem has somewhat strongarmed suppliers to take on stranded customers.

This industry hearsay was somewhat cemented on the 30th September with numerous news outlets including Sky, Reuters and the Financial Times reporting that Ofgem had retained insolvency experts Teneo to act as a standby special administrator if further supplier exits could not be resolved through the SoLR process. A theoretical function previously reserved for action ‘in the unlikely event that a large energy supplier was to go into administration’, under a joint Memorandum of Understanding between Ofgem and the government made in 2017. As this process has to date never been invoked, the practicalities and protections for consumers and remaining suppliers are uncertain. What is more certain however, is that these backstop processes do eventually cost, with parties acting as SoLR able to claim through Ofgem for relevant additional costs they have incurred.

Count out your candy: the uptake in industry reporting requirements

Ofgem has faced pressures from government to explain how the current market conditions appeared to take the nation by surprise. The powers bestowed upon it as the industry regulator do allow Ofgem to request detailed information and data, including financial indicators, from parties operating at all levels of the system from production right through to supply. For example, in April 2020 Ofgem created a new regular Request for Information (RFI) as ‘an emergency tool in response to the first lockdown’ including ‘a range of questions to closely monitor the impact of the covid pandemic on suppliers’ and customers’ financial conditions’. The period of this RFI was extended a number of times, with the final submission due in November 2021, so it is the working assumption that Ofgem could have seen if a number of suppliers were in a precarious position and engage to prevent a shock to the market.

Ofgem’s market side response to the current crisis has continued to rely heavily on such RFIs, with the regulator providing notice of a number of new requests in the last quarter. This includes a contingency RFI for those suppliers with greater than 1% market, similar in its contents to the current Covid template, but only to be invoked if the regulator ‘has reason to believe that more granular or frequency monitoring’ be necessary based on their ‘assessment of the economy and market wide intelligence’. Yet amidst recent crisis Ofgem reverted to a brand-new template entitled ‘Autumn/Winter RFI and Financial Prudence’ to be submitted on a weekly basis until further notice.

These increased reporting requirements have fallen at the same time as the formal launch of the Retail Energy Code (REC) on 1st September 2021. This second version brings code consolidation into effect, bringing together arrangements from existing codes across gas and power. This version also marks the launch of the REC’s Performance Assurance Framework (PAF), containing its own Report Catalogue, obligating industry parities, including suppliers, to provide additional regular reports for consideration of the appointed REC Performance Assurance Provider (Deloitte).

Expelling the green ghouls: transparency of carbon content in energy products

In mid-August, BEIS launched a consultation on so-called greenwashing in the retail power market, stating that ‘the current Renewable Energy Guarantees of Origin (REGOs) and the Fuel Mix Disclosure (FMD) arrangements are not a transparent or effective method of enabling consumers to understand the carbon content as the drive towards net zero gathers pace’. This was underpinned by two interrelated concerns regarding suppliers’ current behavior in the procurement and sale of ‘renewable’ energy:

While the existing content of this call for evidence is highly centered around behavior in the electricity market, the government has stated that they are open to considering interventions that include the emerging ‘green gas’ market and has asked for relevant evidence to interrogate this possible widened scope.

This consultation primarily seeks to understand the greenwashing trends in the retail power market at a high level. While some possible remedies are introduced, including a transparent framework to inform customers of the carbon/cost implications of different options with a greater focus on real time use vs the carbon intensity of the grid, the government indicates the likely implementation of any such remedy would be planned for 2024 at the earliest.

Competition and Markets Authority (CMA) investigation

In the more immediate term, on Tuesday the 21st September the Competition and Markets Authority (CMA) published a paper titled ‘Guidance of environmental claims on goods and services’ following a few years of concern and investigation into generalised greenwashing. The purpose of this guidance is to help businesses understand and comply with their existing obligations under consumer protection law when making environmental claims. The paper, complimented by an online campaign and webpage, sets out a number of key principles that companies should consider when making explicit or implicit environmental claims (through marketing, branding, use of imagery, presentation, text etc.). These include:

These principles may seem ‘common sense’, and are not specific to the energy market, covering commercial practices across any business who makes environmental claims. However, the environmental claims made in relation to energy are specifically referenced in several ‘case study’ examples throughout the document. The CMA plan to review how businesses have put this guidance into practice in the new year.

If your contracts up & renewal looks bad, who you gonna call? TPIs in the retail energy market

Following promises of the Energy White Paper, issued at the end of last year, BEIS has issued a call for evidence on TPIs and how they operate in the market. The call for evidence identifies five broad ‘Risks of Harm’ including:

This paper, which closes for comment of the 6th of December, provides little in the way of specific interventions, instead aiming to draw out the extent of interventions that may be required across various customer groups through a number of structured questions. This relatively conservative approach is likely reflective of the outstanding decision of Ofgem’s Microbusiness Strategic Review, which closed for consultation in July 2021, and proposed a vague autumn implementation date. BEIS expressively stated that it ‘would support any proposal that Ofgem intends to take forward that will improve outcomes for microbusiness customers’ however, with the current state of the market, it would be no surprise if this date was to slip. In any case, when a decision is published the industry will have no less than 56 days before any licence modification takes effect.

To read the call for evidence in full see: www.gov.uk/government/consultations/third-party-intermediaries-in-the-retail-energy-market-call-for-evidence

Pick your poison: BEIS policy published this quarter

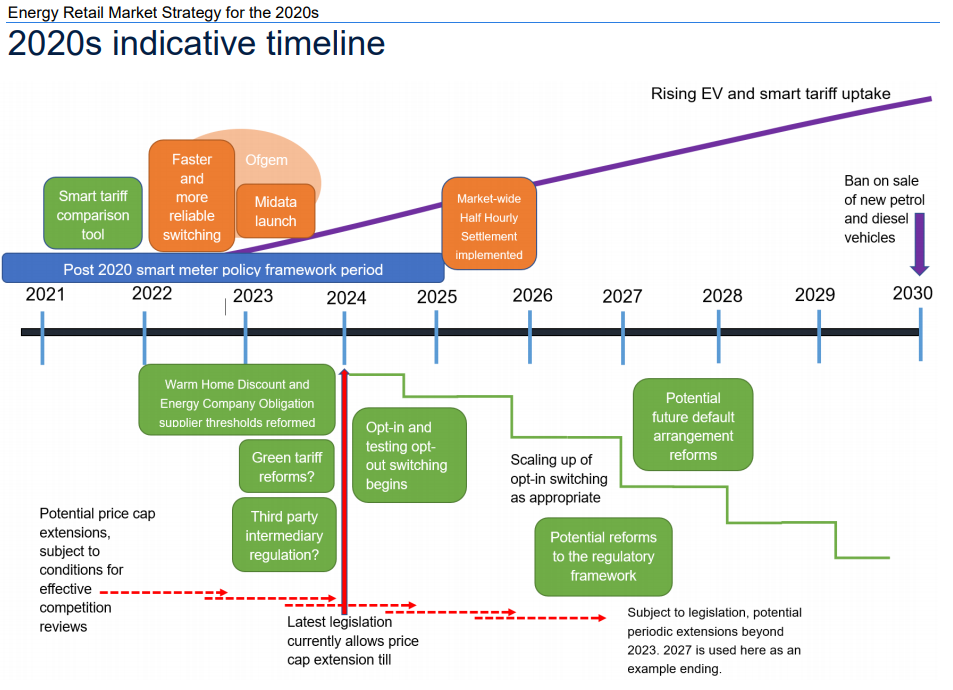

It is often suggested that any storm is preceded by a period of calm, but in the energy industry change is almost constant. This can be illustrated by the bevy of industry policies published by BEIS at the beginning of this quarter, before the full force of the current market storm was evident. On the 23rd July BEIS published its energy retail market strategy for the 2020s, setting out the key goals and indicative timelines for energy policies over the next 10 years.

Unsurprisingly a key tenant of this strategy is the drive to Net Zero 2030, with more granular objectives clearly focused on the consumer experiences of this transition, from ease of engagement and rewarding adaptation, to fair pricing and market protection. Framed in the indicative timeline of this strategy, BEIS subsequently released several further calls for evidence, consultations and policy papers which look to cement their objectives through specific market interventions. These have been briefly outlined in the following table:

| Title | At a glance | Dates |

| Maximising Non-Domestic Smart Meter Consumers Benefits | Proposes all non-domestic customers be entitled a minimum baseline access to their smart/AMR meter data as a free default service from July 2022.

| Published: 05/07/2021 Consultation closed: 24/09/2021 |

| Energy Code Reform: Governance Framework | Proposes preferred models for energy code reform for 2024/26. Aiming to provide strategic direction, empower accountable code management and allow for independent decision making and improve code accessibility through simplification and consolidation. | Published: 20/07/2021 Consultation closed: 28/09/2021 |

| Proposals for a Future System Operator Role (FSO) | Proposes that all current National Grid ESO roles (concerning Electricity Asset Ownership and System Operation), along with certain Gas Roles (not including real time system operation), be combined into an independent/standalone FSO. | Published: 20/07/2021 Consultation closed: 28/09/2021 |

| Domestic Energy Retail: Opt-in and Opt-out Switching | Proposes suppliers share information of disengaged customers with a central body who can inform customers of any better deals across the marker and (opt-in) and eventually manage their switch to such a deal (opt-out). Opt-in implementation and opt-out testing will begin 2024 at the earliest. | Published: 23/07/2021 Consultation closed 15/10/2021 |

| Third-party intermediaries in the retail energy market | See Newsletter summary | Published: 16/08/2021 Consultation closes: 06/12/2021 |

| Transparency of Carbon Content in Energy Products | See Newsletter summary | Published: 16/08/2021 Consultation closes: 06/12/2021 |

| Hydrogen Strategy | Reaffirms the 5GW production capacity for 2030 alongside ~£900m of relevant government funding. A final policy decision on Hydrogen blending expected in autumn 2022. Hydrogen business models and regulatory standards are set to be confirmed in early 2022. | Published: 25/10/2021 |

| Smart Systems and Flexibility Plan | The plan has four key areas of focus: to support flexibility from consumer, remove barriers to flexibility on the grid, reform markets to reward flexibility and monitor flexibility across the system.

| N/a |

| Heat and Buildings Strategy | Phase out of new gas boilers by 2035 and suggestion to mandate ‘hydrogen-ready’ boilers by 2026. Case for hydrogen heating to be decided by 2026. Set a minimal energy efficiency standard of EPC band B by 2030 for privately rented commercial buildings. | Published: 19/10/2021 |

| Net Zero Strategy | This strategy rounds up many of the commitments made in earlier papers including the prime minister’s 10- point plans, the heat and buildings strategy etc. It confirms the government intend to bring forward the target to decarbonise our power system by 15 years, now baselined for 2035. | Published: 19/10/2021 |

On the radar:

What do you want to see in the next issue?

If there is a particular topic or feature that you would like to see in the next newsletter then let us know by contacting your Account Manager or emailing the Crown Gas & Power Regulations Team directly at: jennifer.wilson@crowngas.co.uk.

As usual, we welcome your views and appreciate all the positive feedback that we have received to date.

The information provided in this newsletter is intended to be a general guide and should not be taken to be legal and/or regulatory advice. At no time will Crown Gas & Power actually be or deemed to be providing advice and no actions taken by Crown Gas & Power shall constitute advice to take any particular action or non-action. Whilst every effort is made to provide accurate and complete information in this newsletter, Crown Gas & Power makes no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of the newsletters and expressly disclaims liability for errors and omissions in the contents of this newsletter.