On this page you will find the following information:

The content of this page is kept up to date in accordance with the latest best practice guidance provided by Ofgem.

A key characteristic of the GB non-domestic energy market is one of diversity. No business is the same in terms of its energy needs, its approach to budgeting or ability to pay its arrears when they become due. With diversity brings risk and it is within this market context where Crown Gas & Power has established itself, with our commercial success attributed not only to our competitive products and services, but the existence of a robust credit risk policy. This policy serves as one of our key financial controls, setting out our credit criteria across our business and overall ensuring that the likelihood of bad debt arising is mitigated.

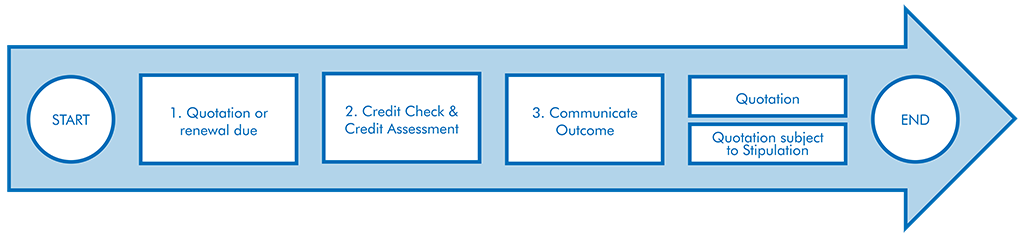

At a high level our process for assessing a customer’s credit worthiness is as follows:

A credit check assessment is undertaken at the point where we are instructed to provide a supply quotation by an authorised person (for example an authorised Third-Party Intermediary). A credit check assessment will also be carried out for existing customers prior to the expiry of an existing Supply Agreement (“contract”).

Company details (such as a company name) allow us to carry out a credit check assessment for the purposes of determining if a quotation can be offered. This information is supplied to Credit Reference Agencies (CRAs) who provide us with information about the organisation such as its credit score and financial history. This information then allows us to undertake a credit assessment.

Taking the information provided by our CRA and combining this with industry information relating to a meter point(s) annual consumption, we can build a credit picture and determine the potential financial risk which we reasonably believe we could be exposed to over the duration of the contract. Our credit risk experts use this data to conduct a credit assessment prior to any quotation being offered. This process considers various factors, for example a credit score, insurance acceptability, the quality of management accounts and payment history (if an existing customer).

Most of our credit risk assessments return a decision within the working day, although complex assessments may take up to two working days. The outcome of an assessment may either accept or reject the contract proposition. It is, however, possible that a contract may still be offered subject to a stipulation(s), for example a different payment method, a different contract duration, a guarantee or even a security deposit.

Rejected and stipulated outcomes will be communicated in writing either directly or indirectly through an authorised TPI. Such communication applies to both new and existing business customers.

This section sets out the following:

At the bottom of this page we have also included some useful Frequently Asked Questions (FAQs).

A possible outcome of our credit assessment process (explained above) may be to offer a contract on condition that a security deposit (“deposit”) is paid in advance.

Should Crown Gas & Power require a deposit, we will communicate the requirement in writing directly or indirectly via an authorised TPI. In every case, we will require a Security Deposit Agreement (“Agreement”) to be read, signed and return to us.

The Agreement is a legal document which sets out the deposit amount required and the terms under which we will request, manage and return it. An accompanying supply contract will only be agreed on condition that the deposit is paid in advance, and that the terms of Agreement continue to be met.

We use a single methodology to determine the security deposit requirements for all customers. The amount requested is unique to each customer reflecting their annual energy consumption and contracted rates. The methodology is not influenced by a particular payment method.

We use the methodology to calculate the exposure (or financial risk) we believe we may be liable for over a 12-month duration.

At a high level the annual contract exposure is derived based on the contracted unit rate and a daily standing charge. The unit rate is calculated with reference to a customers estimated annual consumption. Once derived, we factor in the consumption profile unique to each customer to produce a fully exposed amount. The final deposit amount requested will be a percentage of this amount (a percentage value which is set out within our credit risk policy and regularly reviewed).

All deposits are held in a separate holding account for the duration of the contract. This secure account is separate from our core Crown Gas & Power bank account. No interest will be paid on any held deposit, and its separate nature means that we will not itemise it on a statement of account as a credit balance.

Once a deposit has been paid it cannot be used to offset the payment of any subsequent invoices.

Should a customer not comply with the terms of the Agreement, for example, an invoice amount becomes overdue, then we reserve the right to use the deposit to cover the invoice amount. In such an event the terms of the Agreement require the customer to restore the security deposit back to its original value.

Using a security deposit is often a last resort and we will only do this should all efforts to resolve the outstanding balance be exhausted.

On the matter of VAT, as a deposit is held in our account and not used for a service or sale it will sit outside the scope of VAT. If we actively use the deposit to offset an outstanding debt (as exampled above) then the VAT would be calculated on the energy invoice where the money was originally owed.

Should a customer’s credit score change during the term of the contract, then a request for a security deposit reassessment may be made by contacting our customer services team at hello@crowngas.co.uk or 0161 762 7744 or eChat. The processing of such a request will generally take up to two business days and is solely at the discretion of Crown Gas & Power.

Should the outcome of the reassessment determine that the customers credit position has improved to a level which meets Crown Gas & Powers credit requirements then the security deposit will be returned in full, on condition that there is no outstanding balance on the account.

Should a credit score have deteriorated, then under the terms of the Agreement Crown Gas & Power reserve the right to request that the existing deposit value is increased.

Security deposits will be returned to customers should they switch to an alternative supplier. This is, however, always subject to there being no outstanding balance on the customer’s account.

To request a refund customers must call 0161 546 9940 or email accounts@crowngas.co.uk and provide the following information;

If the originating bank account is no longer accessible to the customer, the customer must provide the new bank details on company letterhead, signed by an individual who is listed at Companies House as an active director of the customer.

Provided that there is no money owing to Crown Gas & Power, the security deposit will be refunded to the originating bank account within 10 business days of receipt of a valid request.

This section sets out the most frequently asked questions from customers who have a security deposit in place with Crown Gas & Power.

Is your question not listed below? Then contact us on 0161 762 7744, eChat, or email us at hello@crowngas.co.uk where our team will find the answer for you.

Your security deposit will be returned if you switch to an alternative supplier or if your credit score improves during the term of your agreement to a level which meet our credit requirement. Both requirements are subject to you having no outstanding balance on your account.

To request a refund of the security deposit the customer must call 0161 546 9940 or email accounts@crowngas.co.uk and provide the following information;

If the originating bank account is no longer accessible to the customer, the customer must provide the new bank details on company letterhead, signed by an individual who is listed at Companies House as an active director of the customer.

Provided that there is no money owing to Crown Gas & Power, the security deposit will be refunded to the originating bank account within 10 business days of receipt of a valid request.

We may use your deposit to cover an invoice amount which is or may become due. After such an event you will be required to restore the deposit back to its original value. Using your security deposit is often a last resort and will only be done so should efforts to resolve outstanding amounts become exhausted.

As security deposits are held on account and not used for a service or sale they therefore sit outside the scope of VAT. If the security deposit is used against any outstanding debt at a later date, then the VAT would be calculated on the bill in which the money was owed.

All security deposits are held in a separate holding account. This secure account is separate to our core Crown Gas & Power bank account.

No, interest will not be paid on any security deposit held.

When you change gas suppliers and get a fantastic deal, you worry that the service may not be good when you need it, you have certainly put that to rest.

Fantastic, Thank you!

Categorically an outstanding, dedicated, professional albeit friendly sitework team who have proactively worked with us to deliver substantial results.

We are really happy with the service from Crown Gas & Power. We submit readings and receive invoices on time.