This year’s Queen’s Speech, delivered by the Prince of Wales on 11th May, included the announcement that an Energy Security Bill is to be introduced at some point over the next parliamentary session. The Bill is a formal vehicle through which the government will deliver commitments that were previously set out in its Ten Point Plan, Net Zero Strategy and most recently the Energy Security Strategy.

Some of the headline commitments underwritten by the bill include:

• The extension of the Retail Energy Price Cap beyond 2023

• The extension of the Energy Intensive Industries Exemption Scheme

• Support for a large-scale hydrogen heating trial in 2026

• Introduction of new business models for Carbon Capture Usage and Storage (CCUS)

• A new market standard and trading scheme for electric heat pumps

• Move to appoint Ofgem as the new regulator for heat networks

• Mechanisms to increase competition in Britain’s onshore electricity networks

• Create a pro-innovation environment for fusion energy

• Formalises the creation of a Futures System Operator (FSO)

The bill reaffirms existing policy trends ensuring that innovation in energy networks and systems, decarbonized heat, home grown renewals and CCUS and low-carbon hydrogen are now firmly at the centre of the government’s agenda. However, criticism has been levied against the bill, and the preceding Energy Security Strategy, for its apparent failure to provide immediate relief in the context of rising energy bills and the emerging costs of living crisis.

However, on 26th May the Chancellor announced a boosted package of cost-of-living support, including an expansion of the Energy Bills Support Scheme through which from October households with a domestic electricity meter will now be given a £400 grant delivered over six months through their electrical energy bill, replacing the previous £200 relief that would have been paid back over subsequent years. The funding for this new grant package is being recovered via an additional 25% tax on UK oil and gas extraction profits named the Energy Profits Levy.

Long live the remaining suppliers: Ofgem’s progressing action plan

Our last Compliance & Regulation newsletter covered the raft of new measures announced by Ofgem at the beginning of 2022. The actions the regulator had both begun to take and or was planning to take in the future were summarized in what it called an ‘Action plan for retail financial resilience’. Progress on this action plan has continued throughout the first quarter of the year and beyond, with a few additional action points announced along the way.

For suppliers, the actions taken to date have seen a significant uptake in the amount of information requested by the regulator, both on an adhoc and enduring basis, so market participants are keen to see any insights the regulator has been able to draw from this and how these insights may direct actions moving forward.

A renewed reign: The move to a quarterly price cap

While the Queen’s Energy Bill underwrote an extension of the retail price cap beyond 2023, the regulator continues to deliberate on what form the cap should take going forward. On 16th May Ofgem published a ‘minded-to’ consultation regarding a move to update the price cap on a quarterly basis rather than every six months. Proposals would also include a shorter notice period provided to suppliers ahead of any cap changes and an updated wholesale allowance to ensure suppliers can recover backwardation costs in a reasonable time (applicable when the current price of energy assets is higher than prices trading in the futures market).

The regulator suggests this move would allow any potential wholesale price falls to be delivered more quickly through to consumers. Furthermore, it may allow suppliers to better manage risk in volatile market conditions, reducing the likelihood of further failures, which ultimately increases costs for consumers. The proposals have been met with skepticism from market commentators and consumer representatives with fuel poverty charity National Energy Action commentating that the changes will open the door to significant price rises during the coldest months of the year, removing the certainty of the price households will pay over winter, which is particularly damaging for many households operating on a tightly planned budget.

The consultation is open until 14th June 2022 with Ofgem minded to implement the changes by October in conjunction with the planned announcement of a new cap rate, which according to the latest information by Ofgem, could see the typical household energy bill increase to £2,800 a year, although continued market volatility throughout the ongoing observation window could see the final figure go up or down.

‘Throne’ out: BEIS not to pursue a quarterly RO obligation

Although picked up by Ofgem’s Action Plan, concerns for mutualisation risks associated with the Renewables Obligation (RO) pre-date the current market crisis. The RO came into effect in 2002 in England, Wales and Scotland, followed by Northern Ireland in 2005. It places an obligation on UK electricity suppliers to source an increasing proportion of their electricity from renewable sources, evidenced by the presentation of Renewables Obligation Certificates (ROCs).

Where suppliers do not present enough ROCs to meet their obligation in the yearly reporting period, they must pay an equivalent amount into a ‘buy-out’ fund. Any funds not recovered by the end of October are then subject to mutualisation across the industry, should the value exceed a predefined threshold. Mutualisation has been triggered over the past four scheme years, despite a significant increase to the relevant threshold in 2021-22, from £15.4m to £64m.

In August 2021 BEIS published a consultation to address supplier payment default under this renewables scheme. The preferred proposal was to introduce a legislative requirement for suppliers to settle their RO more frequently to lower the amount they can default on in a single reporting period. However, in a decision published on 20th April 2022, BEIS announced that it does not think that legislating for more frequent settlement is the right approach, citing significant changes in the energy market.

It is thought that the issue will be revisited later in the year, following progress on Ofgem’s ongoing Action Plan for Retail Financial Resilience, when BEIS will seek to gather more evidence from industry to further develop any future policy thinking.

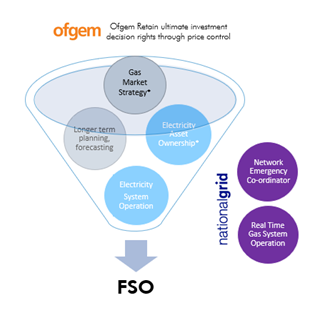

Next in line: The Future System Operator & Code Reform

The government and Ofgem have committed to proceeding with the creation of a new, independent Future System Operator (FSO) broadly along the lines proposed in its consultation document, first published on 20th July 2021. This new public body, to be regulated by Ofgem through a set of bespoke licenses, will incorporate all existing Electricity System Operator functions along with the responsibility for longer term planning, forecasting and market strategy in gas. The responsibility for real time gas system operation and the Network Emergency Co-ordinator role will remain with National Grid.

Ofgem will retain ultimate rights to any investment decision through the direction of price controls. However, the FSO will have a strategic objective to manage the trade-offs and synergies between achieving net zero, securing supply and ensuring an efficient and economic system – with regard to competition, innovation, consumer impact and whole system impacts. In the execution of the above role, Ofgem intends for the FSO to be a data-led organisation and as such will be provided with the statutory powers to request information and data from other licensees including suppliers.

The earliest implementation of the FSO is currently envisioned for 2024, but any such transition will be phased, requiring transactions between government, National Grid Plc and other relevant parties to appropriately compensate for any elements of business transferred to the FSO. The government has not ruled out the potential for the FSO to take on further roles, and hold additional licenses, if required down the line. This could see responsibility for Distribution System Operation, Heat, Transport, Hydrogen, Carbon Capture and Storage and Data being integrated into the FSO role at some point in the future.

There will also be reform to the structure of existing industry codes to take account of the emerging ‘whole-system’ approach. Existing Code administrators and panels will be replaced with a new class of licensed code managers, with an enhanced role to managing and reporting on change in line with a strategic direction set by Ofgem, on the advice of both the FSO and BEIS.

Platinum standard protection: The micro business strategic review

In March, Ofgem published their long-awaited decision in relation to the Micro Business Strategic Review. The final decision is largely in line with the policy package presented for consultation back in June 2021 minus any provision for ‘cooling-off’, which has been dropped from the final decision due to its potential entanglement with the impending implementation of Faster Switching.

The key changes for micro business contracts to be introduced from 1st October 2022 include:

The final change, requiring suppliers to only work with TPIs signed up to a Qualifying Alternative Dispute Resolution Scheme (ADR), is to be introduced from 1st December 2022. Registration for the relevant Ombudsman Scheme went live on 26th April and will close at the end of August.

The Final Furlong: June’s Faster Switching go-live

The Central Switching Service (CSS) is due to go live on 18th July 2022 after years of market design, testing and readiness preparation. Under the new faster and more reliable switching arrangements, applicable to both gas and power, the following will be made possible:

The final run up to go-live will require suppliers to hold back new switches designed for the new Central Switching Service. In order for the CSS to be able to process such a backlog, a short ‘market pause’ will be observed by the industry, during the first week. Whilst industry go live has been deliberately set for mid-month to minimise consumer impacts, any switch to Crown Gas & Power with an effective date of 19th or 20th of July will not be achievable (note: this date range may differ slightly for other suppliers).

BEIS inquiry

At the beginning of the year BEIS opened an inquiry into energy pricing and the future of the energy market. To date the committee has hosted four oral evidence sessions, hearing from a number of industry stakeholders including existing suppliers, failed suppliers, industry trade bodies, consumer representatives, key figures from the regulator and the secretary of state for BEIS. In the most recent session, held on 24th May, Secretary of State, Kwasi Kwarteng was questioned on the outstanding response to a call for evidence around TPIs in the retail energy market, to which he suggested we may expect an update in the summer.

Ofgem report

On 6th May Ofgem published an independent review, conducted by Oxer, of its handing of regulatory arrangements within the context of recent supplier failures following energy wholesale price volatility. The report made several key recommendations around analysing market competition vs market sustainability, smoothing issues with internal communication, fostering proactive stakeholder engagement and better utilising cross-disciplinary skills within the organisation.

Smart meter roll out

On 23rd May BEIS announced that the formula used to set supplier minimum installation requirements in Year 2 of the Targets Framework (from 1st January 2023) will be modified to mitigate the impact of smart meter customers switching supplier, with a specific carve out for customer gained under the SoLR process. This adjustment will apply to Year 2 (2023) installation requirements only.

Market-wide Half Hourly Settlement (MHHS)

On the 21st April Ofgem approved a proposal (CR001) to move the delivery of an industry design baseline (Milestone 5) from 30th April to 29th July 2022, mitigating some of the risks around potential lack of supplier engagement to date.

The information provided in this newsletter is intended to be a general guide and should not be taken to be legal and/or regulatory advice. At no time will Crown Gas & Power actually be or deemed to be providing advice and no actions taken by Crown Gas & Power shall constitute advice to take any particular action or non-action. Whilst every effort is made to provide accurate and complete information in this newsletter, Crown Gas & Power makes no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of the newsletters and expressly disclaims liability for errors and omissions in the contents of this newsletter.