Outside of our office window, situated in the rural-urban fringes of Greater Manchester, spring has finally sprung (alongside an occasional and confusing dusting of snow)! As the horses take their first steps into the green fields opposite Crown Point, many of our colleagues and customers may also be enjoying their first steps on the ‘roadmap’ to a Great British Summer. Meanwhile, in the world of energy policy and regulation, many of the roads in sight continue to circle around the UK’s promise of Net Zero, which looms ever closer following the government’s recent commitment to cut emission by 78% by 2035. Many of these roads are paved by promises of a greener, cleaner, smarter, reliable and integrated energy network, as you will see in following the topics of this quarter’s newsletter.

Citizens Advice Supplier League Table

Green Gas Levy Decision

SMART Metering Roll-out

BEIS Decarbonisation Schemes

Faster switching and the REC

Market Wide Half Hourly

On the Radar

Follow the ‘Gold’ Brick Road: CGP Crowned the Number 1 Non-domestic supplier in Citizens Advice League Table

Just before the recent Easter Bank Holiday, a well-deserved break for our hard-working team, we here at CGP received some very egg-citing news! Crown Gas and Power now rank as the NUMBER ONE non-domestic supplier, according to the most recent complaints figures published by Citizens Advice. CGP were added to the most recent iteration of this table after satisfying a minimum threshold of Microbusiness accounts. Our top position reflects both the overall low number of complaints lodged by our customers, and our Customer Experience Teams prompt and effective handling of complaints we did receive.

To view the full table see: Citizens Advice – How does your non-domestic supplier stack up?

The Emerald City: The Future of Green Gas and the Launch of the Green Gas Support Scheme

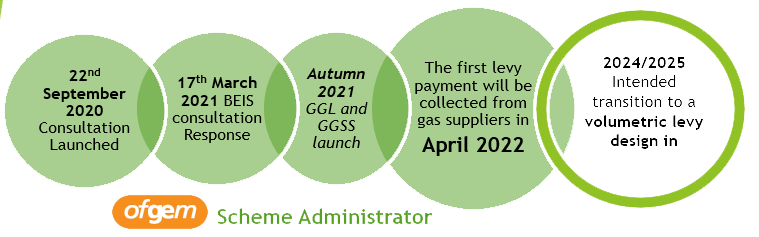

On the 17th of March we saw the Government’s long-awaited response to the proposed Green Gas Levy (GGL), first published for consultation back in September 2020. Despite widespread engagement during its consultation, the final publication itself received very little attention across popular industry news channels. This was possibly due to the fact that the response was incorporated into a wider paper, ‘Future Support for Low Carbon Heat and the Green Gas Levy’, which also addressed a response to the Green Gas Support Scheme (GGSS) and digestate management plan; or because the final decision varied very little from what was initially proposed in the consultation document.

The levy scheme itself is set to launch in Autumn 2021; alongside the launch of the GGSS; however, the first collection of this levy by Ofgem is not expected to be ordered on suppliers until April 2022, with quarterly payments expected thereafter. The only suppliers who will be exempt from this collection are those few who can evidence that between 95-100% of their demand portfolio was serviced by green gas for the entirety of the scheme year. The government intends to launch the scheme on a per meter point design, despite some contention during consultation, stating that this will provide suppliers and consumers with a high certainty of costs and is less complex to implement than the alternative ‘volumetric’ approach (although the government intends to transition to this approach in the next four years). Despite this recognition for the importance of consumer certainty, the exact value of levy, which will be charged to suppliers as a pence per meter per day rate, is yet to be confirmed, with the Government merely stating that, assuming a supplier passes this cost directly to all customers, the expected bill impacts for an average domestic customer are likely to peak at around £4.70 by 2028, further assuming the successful transition to a volumetric levy design. Uncertainty also remains around how Ofgem will seek to collect the data needed to calculate a supplier’s total liability in respect to the levy, namely suppliers individual quarterly meter point data, which may be obtained through a direct request for information across all suppliers or, through some arrangement with the Central Data services Provider (Xoserve).

In line with other renewables schemes (e.g. The Renewables Obligation and Feed in Tariff Scheme), and to protect green gas investment in the case of possible defaulting suppliers, the GGL will be subject to a mutualisation process, whereby any outstanding levy amount, above an undetermined threshold, is to be recovered through the remaining non-defaulting suppliers in the market as a percentage of their total market share. However, unlike previous schemes, supplier payments will be made quarterly, in the hope of preventing excessively large and unexpected annual invoices which can be hard for suppliers to budget for. Furthermore, suppliers will be expected to lodge credit cover worth 115% of their scheme year contribution. Although dressed up as a levy, suppliers are not obligated to itemise the charge.

![]()

Want to further support the Green Gas Revolution?

See what CGP has to offer at Green Gas for your business

![]()

The Scarecrow and the road to getting SMART: ‘All reasonable steps’ obligation to end 31st June 2021

On the 30th of March 2021 Ofgem published their annual open letter to all energy suppliers regarding the ongoing delivery of the smart meter rollout and the associated regulatory obligations, as set out within supplier licences. However, this year the letter comes with only three months left of the current regulation, with the current universally applied framework; which requires suppliers to ‘take all reasonable steps to install smart (and advanced) meters. This framework is set to be replaced by individual minimum annual installation targets for each supplier in the market from the 1st July 2021.

On the 30th of March 2021 Ofgem published their annual open letter to all energy suppliers regarding the ongoing delivery of the smart meter rollout and the associated regulatory obligations, as set out within supplier licences. However, this year the letter comes with only three months left of the current regulation, with the current universally applied framework; which requires suppliers to ‘take all reasonable steps to install smart (and advanced) meters. This framework is set to be replaced by individual minimum annual installation targets for each supplier in the market from the 1st July 2021.

The detailed design of these targets, and crucially the calculations which will underpin them, were published for consultation back in November 2020 (as covered in the CGP’s winter newsletter). While the letter referenced this consultation at the outset, it provided no clarity or apparent timeline regarding Ofgem’s outstanding official response, as we continue to await the publication of individual supplier targets and finalised market-wide tolerances for years one and two of the new scheme.

The remainder of the letter addressed the progress of the rollout over the course of the last 12 months, unsurprisingly referencing the inevitable impact of Covid-19, with all but emergency and essential meter exchanges prohibited in the Spring of 2020. The letter suggests that suppliers have largely been able to re-commence delivery, although it is widely recognised across the industrial and commercial sector that challenges in accessing properties and sites remain across the board with non-domestic suppliers rollout programmes only just starting to remobilise as government restrictions ease. The safety of our customers and colleagues across the industry remains a key consideration at all points of operation and we remain well informed by ongoing government guidance.

See below for the latest government guidance for working safely during coronavirus: https://www.gov.uk/guidance/working-safely-during-coronavirus-covid-19/homes

Who wears the ruby slippers: Non-domestic sites, landlords and small businesses to help lead a smarter greener future?

On the 17th of March the Department for Business, Energy and Industrial Strategy (BEIS) published both its Industrial and Public Sector Decarbonisation Strategies. The strategy papers provided for a variety of funding streams over the next decade which the Government felt would “begin the journey of switching away from fossil fuel and combustion to low carbon alternatives”, specifically referencing the utilisation of key technologies such as carbon capture, usage and storage (CCUS) and increased electrification alongside emerging research into low carbon alternatives, such as hydrogen and green gas.

Furthermore, the Government announced that they were considering a suite of new rules for measuring the energy and carbon performance of some of the UK’s largest commercial and industrial buildings, including office blocks and factories. BEIS went on to suggest that such a combination of measures has the potential to save relevant businesses around £2bn a year in energy costs by 2030.

On the same day BEIS also published a consultation regarding the framework for improving Minimum Energy Efficiency Standards across the Non-Domestic Private Rented sector, in line with the Energy White Paper (EWP) target to ensure all non-domestic rented buildings meet Category B of the Energy Performance Certificate (EPC) standard by 2030, a strategy which will directly target landlords and local authorities and will also have a potential to impact even the smallest of businesses. This consultation, set to close on the 9th of June, first set out the Government’s responses to consultations on its initial White Paper before covering detail on the implementation, enforcement, and delivery of a new framework in Chapters 2 and 3. The consultation concluded in drawing out the possible utilisation of smart meters; inviting views on how they may play a role in supporting landlords in ‘upgrading’ performance standards as part of the next phase of the national roll-out. Although unclear, this may suggest the Government are considering an option to directly link the installation of a smart meter with a building’s EPC standard.

See the consultation here:

‘There is no place like Code’: The Retail Energy Code and Faster Switching

The Retail Energy Code (REC). The REC is providing the framework (and finance) to support the faster switching programme and come September 2021 will see it transition into version 2.0. This new version will represent a significant milestone for the code symbolising Retail Code Consolidation (assuming that Ofgem completes its Significant Code Review).

In version 2.0 the Supply Point Administration Agreement (SPAA), the Master Registration Agreement (MRA) and the Smart Meter Installation Code of Practice (SMICoP) will be incorporated into what is the UK energy markets first dual-fuel code. With consumer outcomes at its heart, the REC will introduce a layer of performance assurance and techniques ensuring that suppliers comply with the requirements of the code. Subject to an ongoing consultation, the new performance assurance framework has been designed to incentivise suppliers in terms of performance and provide clear escalation channels to address those suppliers who continue to under deliver.

In conjunction with this, the Faster and More Reliable Switching Programme continues to progress at pace with the targeted go-live date range planned between 6th June 2022 and 15th August 2022. Between now and then suppliers are continuing to test their internal solutions to ensure that they can interact with the new (and highly secure) Central Switching Service (CSS) come next summer. Supplier testing, engagement and progress against Programme milestones is continuing to occur in the context of independent project assurance, in an effort to support the key decisions made by Ofgem.

Over the next few months, the largest suppliers will be starting their connectivity testing with the CSS which will open the door to general testing with the new industry system. Indeed, between May and August 2021 all supplier parties will eventually start their own user entry process testing phase with completion expected by November 2021.

As the programme edges closer to the new year, we have already started to see the first technical papers about the transition and go live into the CSS solution. Over the next few months such pathways will become more defined with timeframes drafted and agreed to support supplier business processes (and their consumers) with understanding when the last ‘old world’ switch and first ‘new world’ switches can be made and how ‘in flight’ switches will be managed. Such guidance is expected to be published by Ofgem over the coming months along with expected supply license changes to support the new switching arrangements.

Key timeframes for your 2022 diary:

Go live date determination (decision expected 21st Jan 2022)

Planned faster switching go live range (6th June 22 to 15th Aug 22)

‘We’re not in Kansas anymore’; The Future of Market Wide Half Hourly Settlement

Led by Ofgem, albeit now to be managed by Elexon moving forward, the Market-wide Half-Hourly Settlement (MHHS) programme is arguable one of the largest, most fundamental changes to the energy retail market since deregulation. The programme; which is planned to be completed by October 2025; will increase incentives on suppliers to develop innovative smart style tariffs that promote demand side load shifting; bringing smaller non-domestic and domestic sites in line with large consuming non-domestic sites by allowing consumption data to be recorded every thirty minutes.

For a full view of the publication see here: https://www.ofgem.gov.uk/publications-and-updates/electricity-retail-market-wide-half-hourly-settlement-decision-and-full-business-case

On the Radar:

For more information, including how to get your hands on the signal, visit: https://www.nationalgrid.com/greenlightsignal

External Resources

The energy market is complex owing to the many stakeholders and big data which it entertains. Nevertheless, the links below provide some useful information which may help satisfy your curiosity or be of some use if you wish to understand more.

– An Introductory Guide to the GB Energy Industry, available at: https://es.catapult.org.uk/brochures/the-importance-of-the-gb-energy-sector/

– The Energy Podcast (by Shell), available at https://open.spotify.com/show/5MZ49KQvbHjt4PIGQ3yFqn

– GB Gas Industry for Dummies, available at: https://www.cgi.com/uk/en-gb/article/gb-gas-industry-for-dummies

– GB Electricity Industry for Dummies, available at: https://www.cgi.com/uk/en-gb/gb-electricity-for-dummies

What do you want to see in the next issue?

If there is a particular topic or feature that you would like to see in the next newsletter then let us know by contacting your Account Manager or emailing the Crown Gas and Power regulations team directly at: jennifer.wilson@crowngas.co.uk.

As usual, we welcome your views and appreciate all the positive feedback that we have received to date.